-

Accepting Responsibility when the lights go out – Videoblog 57

Minister for Finance Prof. Edward Scicluna discusses the recent power cut which affected Maltese households and businesses. He explains that despite they are not desirable and should be avoided, there is always a risk that such unforeseen incidents take place. He notes that this is why essential operations are, or should be, equipped with…

-

Strong Employment in Sensitive Sectors – Videoblog 56

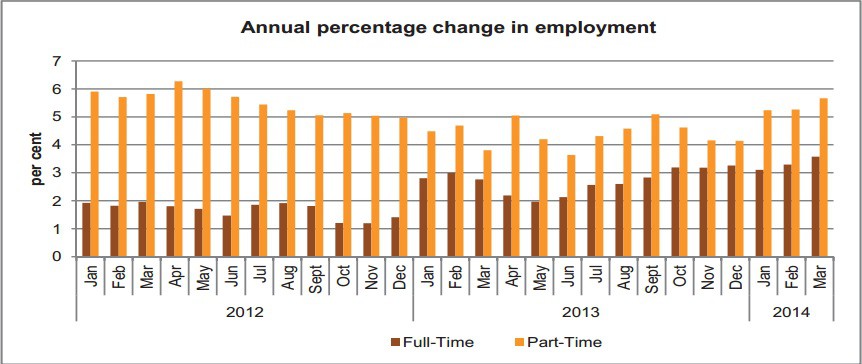

Minister for Finance Prof. Edward Scicluna discusses recently published employment figures as published by the National Statistics Office. Prof. Edward Scicluna explains that the figures show an increase in full time employment of 3.6%, as well as a rise in part time employment by 6.3%. He notes that such rates that were never reached before.…

-

The Importance of Forward-Looking Economic Indicators – Videoblog 55

Finance Minister Prof. Edward Scicluna discusses recently published EUROSTAT data which deals with the confidence of European consumers in their respective economies. Prof. Scicluna explains that the data was welcome news for the Maltese Government, as the data showed that consumer confidence is in the local economy strong, that income from work is increasing,…

-

Greater oversight over public finances – Videoblog 54

Minister for Finance Prof. Edward Scicluna announces the approval of the Fiscal Responsibility Act. He explains that this Act represents a milestone for the Maltese government, as it binds this and all future government to a greater degree of transparency and accountability in public finance. Prof. Scicluna explains that the only existing checks and…

-

Malta and EBRD exploring opportunities for cooperation – Videoblog 53

In this videoblog, Minister for Finance Prof. Edward Scicluna discusses the European Bank for Reconstruction and Development (EBRD). He explains that it is a European banking institution that carries out crucial development projects with a special focus on former Soviet Union countries. He explains that the majority of shareholders, which include Malta, are European countries…

-

Government Finances in line with 2014 Budget Projections – Videoblog 52

Minister for Finance Prof. Edward Scicluna discusses the fast-approaching Budget Period, and preparations that are underway within the Ministry for Finance in this regard. He explains that during this time, the Ministry would not only be analyzing the government’s finances and comparing them against projections, but also determining those proposals that will be…

-

Do taxpayers trust governments with their money? – Videoblog 51

Finance Minister Prof. Edward Scicluna discusses the Fiscal Responsibility Act, which he presented recently for its Second Reading in Parliament. Minister Scicluna underlines that the Act is important because it establishes certain checks and balances on all future Maltese governments to keep public finances on track in an accountable and transparent manner. He explains…

-

Government Finances in line with 2014 Budget Projections – Videoblog 50

In his weekly video blog, Minister for Finance Prof. Edward Scicluna discusses the fast-approaching Budget Period, and preparations that are underway within the Ministry for Finance in this regard. He explains that during this time, the Ministry would not only be analyzing the government’s finances and comparing them against projections, but also determining those…

-

Deflation: Is it for real? – Videoblog 49

“In his weekly video blog, Minister for Finance Prof. Edward Scicluna discusses the concept of inflation and deflation, and how this affects Maltese and Gozitan households on a day-to-day basis in terms of how much they earn, and the worth of their savings over time. Prof. Scicluna also notes that in those instances where…

-

Right time to become fully tax compliant – Videoblog 48

Finance Minister Prof. Edward Scicluna discusses the recently-launched Asset Registration Programme, which represents an opportunity for individuals and companies to declare previously undeclared assets (both local and abroad) and regularise their tax position. He explains that by means of this programme, companies and individuals will be able to register undeclared deposit accounts, shares, bonds,…