-

Finance Minister stresses importance of economic and financial stability

The current situation in Greece reminds us of the importance of economic and financial stability and of the big price a country ends up paying when it loses it, Minister for Finance, Edward Scicluna, said. PRESS RELEASE ISSUED BY THE MINISTRY FOR FINANCE Addressing guests present for the launch of a second, €75 million, Malta Trade for Growth Fund by…

-

Finance Minister welcomes Council’s decision to abrogate the EDP against Malta

Speaking at a meeting of the Economic and Financial Affairs (ECOFIN) in Luxembourg, the Minister for Finance, Professor Edward Scicluna welcomed the Council`s decision on the abrogation of the excessive deficit procedure against Malta. “We promised that we would do it. It was not easy to accomplish, but we are pleased we have managed. Our…

-

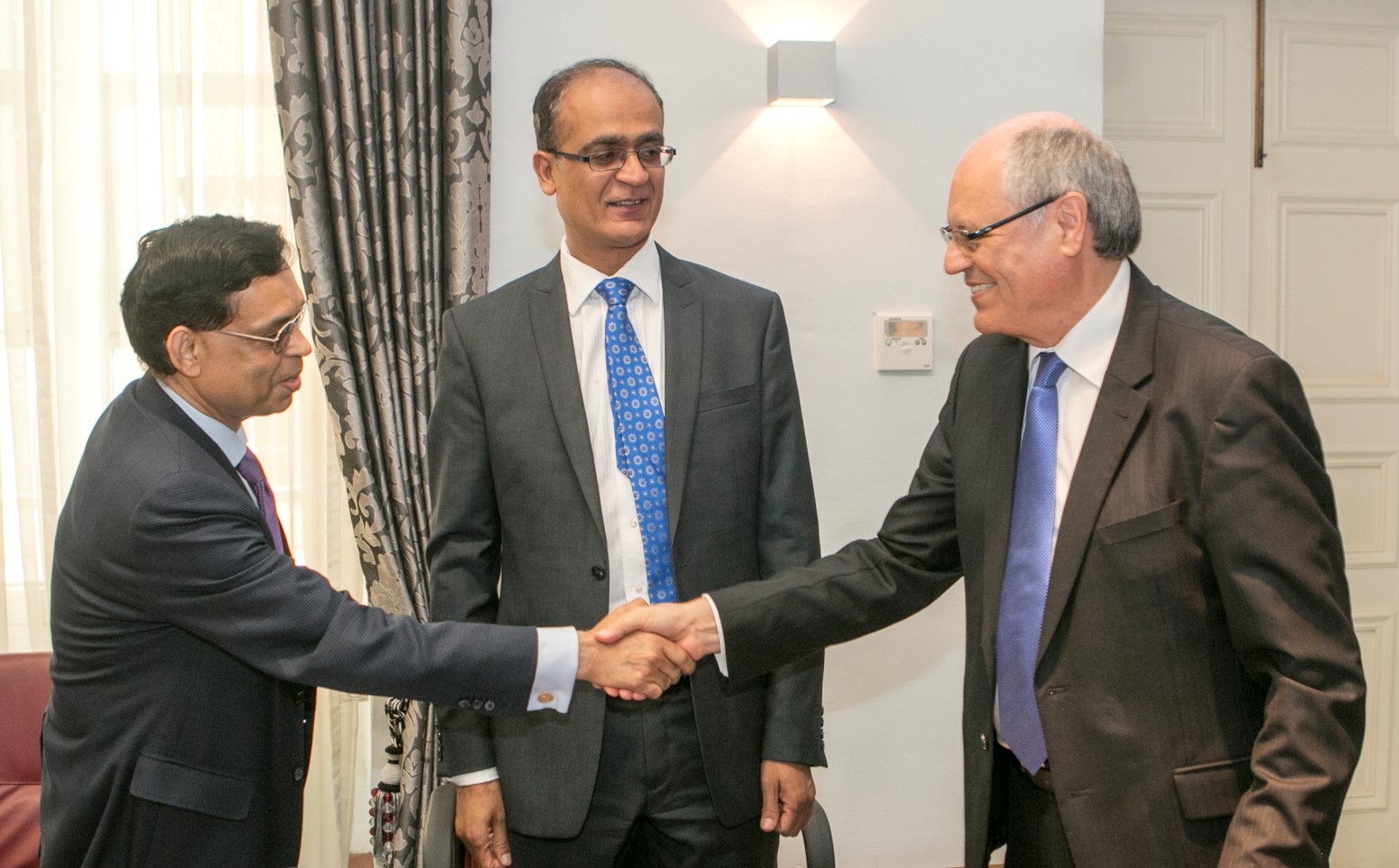

Minister for Finance meets Deputy Secretary General of the Commonwealth Secretariat and the Chief Investment Officer of the International Finance Corporation

Prof. Edward Scicluna, Minister for Finance, has received a courtesy call by Mr Deodat Maharaj, Deputy Secretary General (Economic and Social Development) at the Commonwealth Secretariat and Mr Arun Sharma, Chief Investment Officer of the International Finance Corporation. PRESS RELEASE BY THE MINISTRY FOR FINANCE The aim of the visit was to take stock of the preparations…

-

Ernst and Young confirm the positive outlook for the Maltese economy

The Ministry for Finance notes with satisfaction the forecast by Ernst and Young (EY) which was issued earlier today. EY, in collaboration with Oxford Economics, is foreseeing a strong performance by the Maltese economy during this year, supported by a buoyant tourism sector, robust consumer spending and growth in exports. PRESS RELEASE ISSUED BY THE MINISTRY FOR FINANCE Minister for…

-

Imnedija Strateġija għal Sistema ta’ Pensjoni Adegwata u Sostenibbli

F’laqgħa konġunta bejn il-Kunsill Malti għall-Iżvilupp Ekonomiku u Soċjali l-MCESD u l-membri tal-MEUSAC, il-Grupp għall-Istrateġija tal-pensjonijiet nieda l-Istrateġija għal Sistema ta’ Pensjoni Adegwata u Sostenibbli. Fost il-proposti elenkati hemm dawk li ma jogħlewx la r-rata tal-irtirar u lanqas ir-rata tal-kontribuzzjoni tas-sigurtà soċjali Fil-ftuħ tal-laqgħa l-Ministru għad-Djalogu Socjali Affarijiet tal-Konsumatur u Libertajiet Ċivili Dr Helena Dalli tkellmet fuq l-importanza li min…

-

Debt-to-GDP ratio on a downward trend

Debt statistics published today by the NSO confirm that Government is managing to decrease the debt burden on the Maltese economy. Figures show that national debt as a percentage of GDP fell from 69.2 per cent in 2013 to 68.0 per cent in 2014, meaning that the Government managed to reduce the debt-to-GDP ratio by…

-

Ministry for Finance organises health and safety awareness event for employees

Minister for Finance, Edward Scicluna, congratulated the Ministry’s recently set-up Wellbeing Unit for the organisation of its first event to create awareness on occupational health and safety amongst the staff. The Unit, which forms part of the Ministry’s Corporate Services Directorate, has over the past weeks offered employees courses on first aid, fire emergencies, and…

-

Finance Minister requests investigation into Mater Dei processes

Minister for Finance Edward Scicluna has requested the Auditor General to carry out an investigation into the processes of the Mater Dei Hospital project in the light of the findings of the report of the Mater Dei Inquiry Board, headed by Justice Emeritus Philip Sciberras, into the structural defects present at the hospital building. PRESS…

-

Vistra Group’s 5th Anniversary Celebration

Minister for Finance, Prof. Edward Scicluna, said that the Government’s role is to ensure political stability, exercise fiscal prudence, and reduce bureaucracy as much as it can, thus allowing businesses to grow, thrive and create employment. Speaking during Vistra Group’s 5th anniversary celebration at The Saluting Battery in Valletta, the Minister commended the…

-

Reduced Tax on Rent

The Government has launched a new withholding tax on rent, whereby the rate of tax on income from rented properties would be reduced from a maximum of 35% to 15%, tax evasion will be discouraged, and government revenue will increase. The 15% tax rate would be applicable to rented properties for residential purposes,…