The Ministry for Finance considers Malta’s VAT mechanism as one of the most efficient among the EU’s 28 member states. This goes completely contrary to what was reported by the European Commission in its recently published report for 2012.

While the Commission estimates some €241 million were lost to tax evasion in 2012, the Ministry’s own estimates point to a loss of €34 million in 2012, and less than €11 million in 2013.

The reason for this large discrepancy is that, from this year’s report for 2012, the Commission has included all the exported services supplied by the online gaming industry as non-recoverable VAT, while in practice, this industry is, up to now, exempted from charging VAT. The Ministry for Finance will be communicating this clarification to the European Commission.

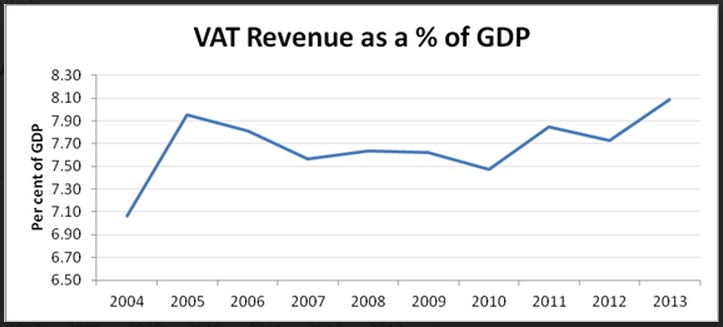

This places Malta at the top end of the list among the most efficient collectors of VAT. In 2013, Malta collected 8.1 percent of GDP in VAT revenues, a record percentage, in spite of how VAT rates have remained stable at 18 percent (see chart below). This is also corroborated by the Commission’s previous report.

This high level performance does not mean that tax evasion does not exist. In fact, various administrative and regulatory measures are being introduced so that tax evasion is minimised further.

4th November 2014