Malta joined the euro area in 2008 in order to further enhance its macroeconomic and financial stability, and to contribute to the stability of the euro area-wide economic and financial system. Together with other EU Member States, Malta participated in the setting up of a euro area regulatory and supervisory framework which includes the European Systemic Risk Board (ESRB) and the European Supervisory Authorities (ESAs).

Malta contributes actively to these institutions’ oversight activities which have included the stress-testing of systemically important banks. Furthermore, the national financial regulatory and supervisory system is regularly subject to assessments by international organisations including the EU and the IMF.

Malta supports the argument of the Luxembourg Government that the banking system of an EU Member State, being part of the Single Market and, subsequently, of a developing Banking Union, cannot be regarded in isolation. Malta forms an integral part of the euro area financial system.

Malta fully supports an adjustment programme which is required by a Member State to re-establish sound macro-economic and financial stability. In this respect, Malta subscribes to the one-off measures undertaken with regards to Cyprus.

The Euro Group’s statement of 25 March concerning Cyprus calls for the downsizing of its domestic banking sector to reach the euro area average by 2018. The size of Malta’s domestic banking system is at present below the euro area average. The five domestically-oriented banks have total assets of 218 percent of GDP, while the eight banks with limited links to the domestic market have assets totalling 77 percent of GDP. The rest of Malta’s banking sector is made up of 14 international banks with no links to the domestic economy, with assets totalling 494 percent of GDP.

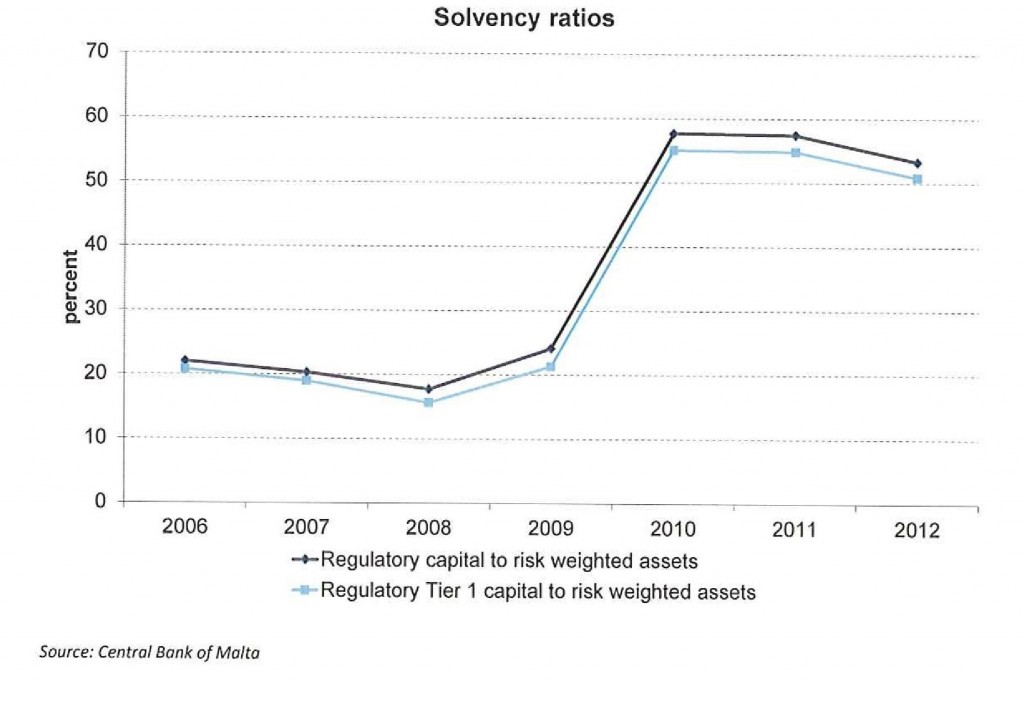

Moreover, the asset holding of the total banking sector is well diversified and with very limited exposure to the programme countries. The World Economic Forum ranks Malta 13th out of 144 countries in terms of the soundness of its banking sector. The banking system has strong solvency ratios. It is also well capitalised with an overall capital adequacy ratio above 50 percent, exceeding significantly the minimum regulatory requirement of 8 percent under the Capital Requirement Directive.

– Thursday, 28th March, 2013